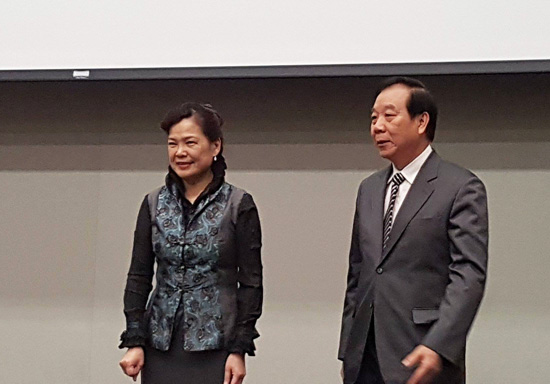

Figure 1: Vice minister of economic affairs Wang Mei-hua (left) and secretary general of the Chinese National Federation of Industries Tsai Lien-sheng; Photo by Conor Stuart

There have been a series of media reports over recent months questioning the Taiwanese government’s role in pushing forward a policy to encourage stronger business, trade and educational links with South East Asia, South Asia, Australia and New Zealand -- “the New Southbound Policy”.

[We provided an overview of the policy in a previous issue.]

One such critique, penned by Joe Tsai, a columnist for our Chinese-language sister newsletter stated his concerns as follows:

“Contrary to Donald Trump's efforts to encourage businesses to come back to the US, the Taiwanese government is calling for businesses to move overseas, this is not what the Taiwanese government should be doing. Whether it is moving westward into China, northward toward Japan, southward into South East Asia or eastward towards the US, there is always room for pursuing profit on the free market, and keen-eyed business people will know how to do it, and don't need the government to spell it out for them or point the way. If there is a business opportunity, businesses will invest there; in a free democratic country, the government couldn’t stop them even if they wanted to [...] It’s not hard to see, that the Southbound Policy, aimed at South East Asia, is an attempt by the new government to replace the westbound movement into China. It’s an ideological trade-off of a policy, but whether it is aimed at China, Japan, South East Asia or the US, the government should not be leading through policy. The government’s function is to build a solid investment environment and to raise the competitiveness of Taiwanese businesses; it doesn’t need to encourage businesses to move abroad.”

A junior executive at a Taiwanese-owned textile manufacturing company with three factories in Cambodia and Vietnam drew attention to other issues, stating to the IP Observer that the ruling Democratic Progressive Party (DPP) has yet to take any substantive action with regards to the policy and that the high price of labor means that their factories in the countries have not been as profitable as those elsewhere. Added to this are tariff and non-tariff barriers set to remain in place given the failure of the TPP to get off the ground. This means that worker salaries are higher than in other places and that it is more expensive for Taiwanese companies to export products than it is when they work in eligible southern African countries which enjoy duty-free apparel and textile exports to the United States under the African Growth and Opportunity Act (AGOA) program.

At a forum on the New Southbound Policy on January 18th both Tsai Lien-sheng, the secretary-general of the Chinese National Federation of Industries (CNFI) and vice minister of economic affairs Wang Mei-hua, pushed back on criticism. In answer to suggestions of an ideological “anti-China” agenda to the policy, Tsai stated “When pushing forward the New Southbound Policy, we can’t ignore the importance of China to ASEAN countries. Just because we’re pushing forward the New Southbound policy, doesn’t mean that we should give up on the Chinese market. I visited China after [Tsai Ing-wen’s inauguration on] May 20th of 2016 and they asked if the New Southbound policy was aimed at distancing ourselves from Mainland China. And we replied that it wasn’t.”

He also stated his hope that there would be opportunities to continue to cooperate with China in trilateral trade relations with other countries, given the latter’s Silk Road Economic Belt and 21st-century Maritime Silk Road initiatives hinge on cooperation with many of the same countries involved in the New Southbound Policy. Tsai acknowledged the tariff and non-tariff barriers which reduce Taiwan’s competitiveness in trading with the countries in lieu of an FTA between Taiwan and ASEAN.

Wang Mei-hua pointed out that part of the motivation behind the policy is the established networks of Taiwanese businesses already present in the region (See Tables 1, 2 and 3). Ministerial meetings between Taiwan and the Philippines, for example, are already in their 23rd year. She added that the official figures for Taiwanese investment in these countries and regions differ significantly from the figures offered by private entities, likely because many Taiwanese investors, approach the region from their bases in China.

Table 1: Investment in ASEAN countries by Taiwanese businesses; Source: Investment authorities in country specified, Economic Divisions of Taiwan Representative Offices in country specified and the Investment Commission of the Ministry of Economic Affairs

Country |

Taiwan Investments |

Total Taiwanese Investment (US$) |

Representative Taiwanese Businesses in Country |

Myanmar |

200 |

US$356 million |

- Asia Optical

- Tahsin (garment manufacturer)

- Pou Chen Corporation (footwear manufacturer)

- Known-You Seed Co.

|

Thailand |

2,311 |

US$14.5 billion |

- Delta Electronics

- Cal-Comp Electronics

- Cheng Hsin Rubber Industry

- Namchow Chemical Industrial Co.

|

Cambodia |

347 |

US$1.1 billion |

- Medtecs International Corporation Limited (Medical Devices and Textiles)

- Makalot Industrial Co. (Garments)

- Chung Hsin Hotel

|

Vietnam |

2,495 |

US$31.6 billion |

- Central Trading and Development Group

- Vedan (MSG producer)

- SYM Motors

- Formosa Plastics Group

|

Laos |

4 |

US$35.8 million |

- China Unique Garments Manufacturing Co.

- Poppy Asia Co. (Construction and Urban Development)

|

Malaysia |

2,481 |

US$12.2 billion |

- Yungshin Pharmaceutical Industry

- Evergreen Heavy Industrial Corp.

- TECO Electric & Machinery Co.

- Action Electronics Co.

|

Singapore |

572 |

US$11.9 billion |

- Mediatek

- United Microelectronics Corporation (UMC)

- Chang Chun Plastics

- AU Optronics

|

Indonesia |

2,233 |

US$17.3 billion |

- Maxxis Tires

- Feng Tay Shoes

- E. United Group (Steel)

- Din Tai Fung (Restaurant chain)

|

Brunei |

60 |

US$82.3 million |

- Golden Corporation (prawn farming)

- Van Shine Trading Limited

- Viva Pharmaceutical

|

The Philippines |

1,085 |

US$2.3 billion |

- Wistron (ODM)

- New Kinpo Group (Electronics)

- Formosa Heavy Industries Corp.

- Uni-President Enterprises Corporation (Food)

|

Table 2: Investment in South Asia by Taiwanese businesses; Source: Investment authorities in country specified, Economic Divisions of Taiwan Representative Offices in country specified and the Investment Commission of the Ministry of Economic Affairs

Country |

Taiwan Investments |

Total Taiwanese Investment (US$) |

Representative Taiwanese Companies in Country |

India |

90 |

US$1.5 billion |

- Hon Hai Group

- China Steel Corporation

- Feng Tay Shoes

- Cheng Hsin Rubber Industry

|

Bangladesh |

46 |

US$290 million |

- Run Xing Textile Company

- Pou Chen Corporation (footwear manufacturer)

|

Sri Lanka |

5 |

US$500,000 |

|

Table 3: Investment in Australian and New Zealand by Taiwanese businesses; Source: Investment authorities in country specified, Economic Divisions of Taiwan Representative Offices in country specified and the Investment Commission of the Ministry of Economic Affairs

Country |

Taiwan Investments |

Total Taiwanese Investment (US$) |

Representative Taiwanese Companies in Country |

Australia |

87 |

US$2 billion |

- Taiwan Power Company

- China Steel Corporation

- Tien Ren’s Tea

- Din Tai Fung (Restaurant)

|

New Zealand |

9 |

US$6.6 million |

- TECO Electric & Machinery Co.

|

Addressing the claim from some quarters that the eagerness to work with Japan was also motivated by anti-China sentiment, Wang outlined the process of seeking out third parties to work with in approaching the policy as follows:

“As part of the New Southbound Policy, we’ve considered working with a third country, to cooperate with in opening up the market. So we often hear about Japan, for example. The Japanese really aren’t dumb. Every year Japan does an evaluation on every country. So Japan agreed at once to work with us. We were a bit taken aback at how easy it was for us. Japan was aware that Taiwan has a lot of connections in the countries in South East Asia with which we have closer relations. The ones they most often bring up are Vietnam, Indonesia, and now, Malaysia. Many of the industry chains operated by Taiwanese business people could complement those owned by Japanese business people. When we asked them to bring us with them to India, however, they said ‘No way! We’re much stronger than you in the Indian market, so we can’t work with you on it, we’d have to spoon-feed you.’ This contrasts quite starkly with their suggestions on Vietnam where they said that given our base in the country, we could work together and that two would be stronger than one. So this is what Japan was interested in.”

She stated that the reason the government are pushing the policy is that supply chain problems can be overcome if Taiwanese businesses go there in numbers, rather than planning simply on an individual firm basis. She added that the Taiwan External Trade Development Council has also been able to provide big data support for companies in assessing local demand in the different countries of the region.

Figure 2: Deputy Director General of the Industrial Development Bureau Hsiao Chen-Jung; Photo by Conor Stuart

The deputy director general of the Industrial Development Bureau Hsiao Chen-Jung stated that he often faces questions as to why the government is seemingly pushing Taiwanese companies overseas. In response he stated that the policy was not aimed at pushing companies overseas, but rather at extending cooperation on industrial supply chains and expanding the market reach of Taiwanese companies to cater to the needs of ASEAN and South Asian markets.

He also stated that given the derailment of the Transpacific Partnership Agreement (TPP) in the wake of the election of President Donald Trump in the US, industry cooperation with companies in ASEAN countries can help Taiwanese companies when it comes to tariffs on exports elsewhere. He referenced various free trade agreements (FTA) that have been signed or are under discussion between the ASEAN Economic Community or individual ASEAN countries and other countries that allow their businesses to take advantage of tariff-free treatment or discounted tariffs on exports. He cited the example of the FTA under discussion between Vietnam and the European Union, which will reduce the tariffs on 99% of products, including textiles to zero, whereas Taiwan has to pay tariffs of 5-20% when exporting to the EU. Cooperation between industries in Taiwan and Vietnam could then possibly save Taiwanese businesses paying these tariffs when exporting products to the EU.

He also said that it’s the government’s role to negotiate to see if there is any room for negotiation on tariffs for certain products.

The government have launched an official website for the New Southbound Policy which provides more information on the details of the policy.

|

|

| Author: |

Conor Stuart |

| Current Post: |

Senior Editor, IP Observer |

| Education: |

MA Taiwanese Literature, National Taiwan University

BA Chinese and Spanish, Leeds University, UK |

| Experience: |

Translator/Editor, Want China Times

Editor, Erenlai Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|