Taiwan Semiconductor Manufacturing Company (TSMC) was in the top spot in terms of domestic patent applicants in 2016, the company’s first time in the top spot, ousting Hon Hai Precision Instruments – known more widely by its trade name Foxconn. Hon Hai fell from the top spot for the first time in 14 years, taking third place, however it still remained top in terms of patents granted to Taiwanese applicants with 982.

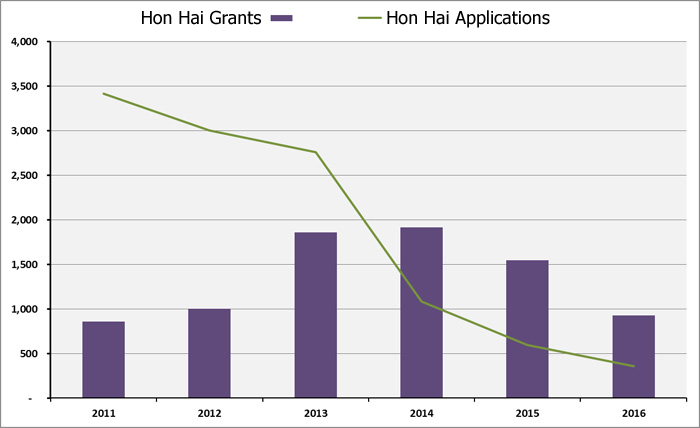

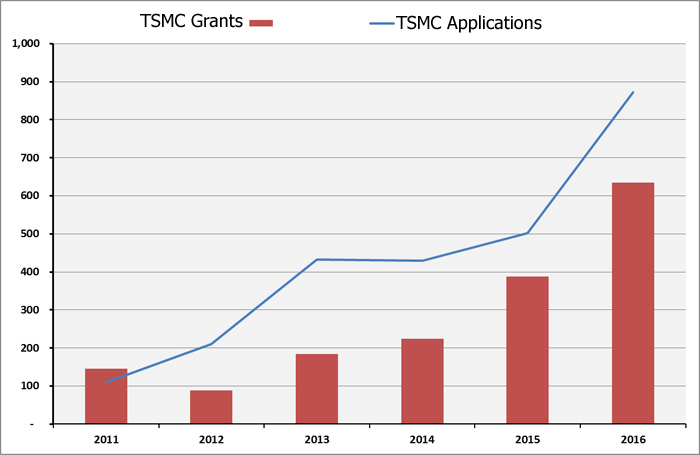

In most cases patent applications are published 18 months after they are filed and are then subject to a substantive examination. Patents are normally granted within 20 months of a request for a substantial examination in Taiwan. That TSMC has already taken over from Hon Hai in terms of patent applications published suggests a sustained decline in applications from Hon Hai (See Figure 1 and 2).

Figure 1: Hon Hai invention patent grants vs applications, 2011-2016; Source : TIPO Report

Figure 2: TSMC invention patent grants vs applications, 2011-2016; Source : TIPO Report

In 2016, among the top 100 local applicants, there were 65 companies, with TMSC – which only entered the top ten in 2013 – expanding its patent filings, overtaking the Industrial Technology Research Institute in 2015 and then Hon Hai in 2016. Non-profit ITRI filed 468 applications, still maintaining its No. 2 position. Hon Hai has changed its patent strategy dramatically, reducing its applications by 40%.

In terms of foreign applicants, the US-based Intel led with 905 applications and 854 grants; US-based Qualcomm filed 616 applications, with growth of 60% on last year, up from the 13th spot in 2015 to No. 2 in 2016. Japan’s Semiconductor Laboratory applied for 470 patents, in third place with growth of 30%.

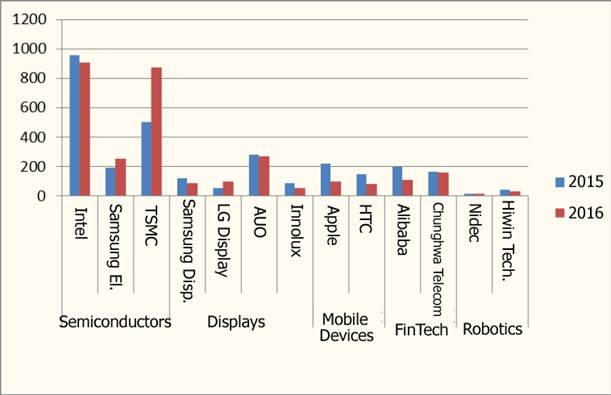

In terms of patent applications by businesses across various industries, semiconductors have had some ebb and flow, with US-based Intel increasing applications by 5% on last year; Taiwan’s TSMC followed close behind with 873 filings, growth of 74% on last year; South Korea’s Samsung filed 252 applications, with growth of 30% on last year.

In the panel sector, as well as South Korea’s LG Electronics (98 applications) up by 88% on last year, South Korean Samsung Display (88 applications) reduced its applications by 25%, while Taiwan’s AUO (with 268 applications) and Innolux (with 56 applications) reduced applications by 5% and 36% respectively. The mobile devices sector saw a reduction in applications, with US-based Apple (99 patent applications) and Taiwan’s HTC making reductions of 55% and 45% respectively. In the FinTech arena, Alibaba applied for 111 patents, a decrease of 44%, and Taiwan’s Chung-Hwa Telecom (160 applications) kept applications more or less level from last year. In the robotics field, Japan’s Nidec Sankyo applied for 14 patents, down 18% from last year, Taiwan’s Hiwin Technologies applied for 33 patents, down 27% (see Figure. 3).

Figure 3: Patent applications by firms in competitive industries; Source: TIPO Report

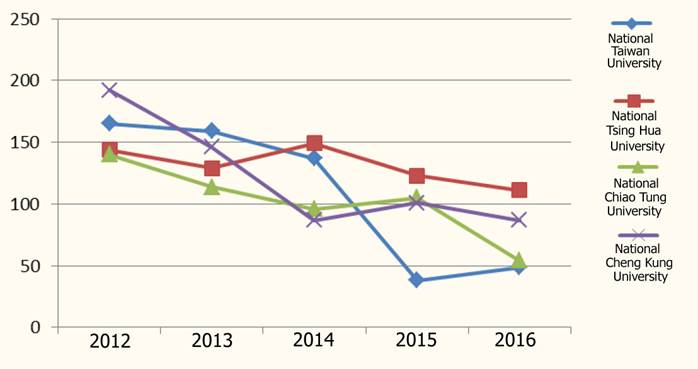

In terms of higher education institutions, 29 local institutions were in the top 100, among them Far East University applied for 222, leading all academic institutions, in 8th place among all domestic applicants, with utility model patents making up the bulk of its applications at 178. In second place was Taipei City University of Science and Technology with 172 patent applications, in ninth place among domestic entities. Looking solely at invention patent applications, the rankings were led by National Tsing Hua University once again in first place with 111 applications, with most other of the top institutions, with the exception of National Taiwan University (NTU), seeing a fall of 10%-49% in applications. NTU saw a 30% rise in applications to 49, while National Chiao Tung University filed 54, and National Cheng Kung University filed 87. NCTU saw the biggest reduction down 49% (see Figure 4).

Figure 4: Invention patent applications filed by top four Taiwan universities; Source: TIPO report

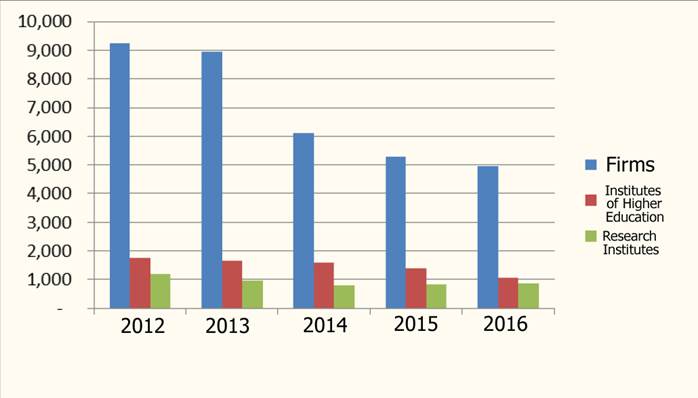

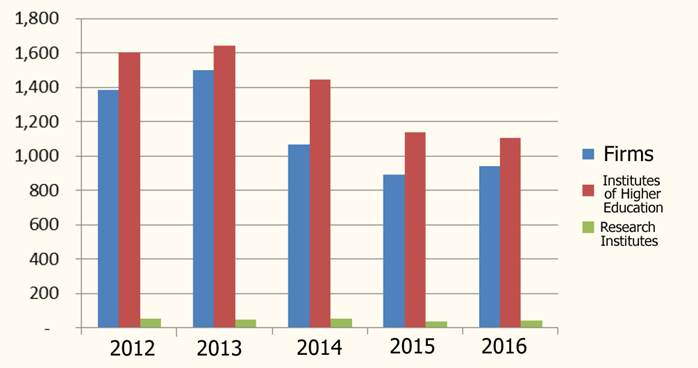

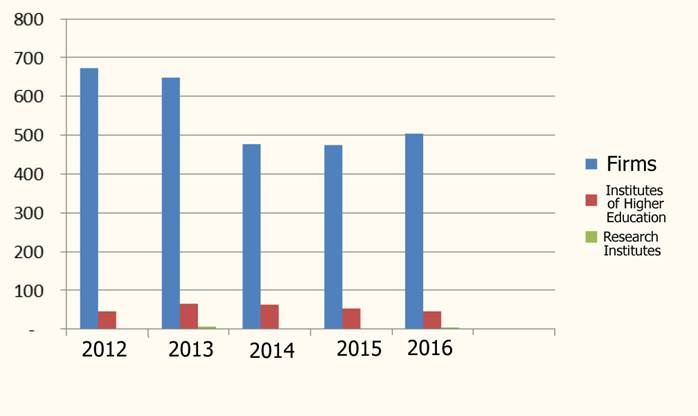

Local research institutions, occupied 6 places in the top 100 invention patent applicants by entity, among which ITRI applied for 468, maintaining its level from last year and keeping the top spot among research institutions from last year; The Metal Industries Research and Development Centre applied for 154 patents, its best performance yet. In terms of local applicants, invention patent applications have fallen steeply since 2014. But this fall slowed in 2016, and utility model and design patents have both shown growth. Companies applied for 4,955 invention patents, down 6.5% year on year, a smaller decrease than in 2014 and 2015; Academic institutions saw 1,054 applications, down 24%, which was a steeper decline, meaning that invention patent applications totaled 6,870, down 9% on last year; Utility model patent applications saw a decrease in the decline in applications from academic institutions and a rise in applications from businesses, which led to a slight rise in utility model patent applications in the top 100 of 1% to 2,094; Design patent applications, on the other hand, saw growth due to growth in applications by businesses, fueling growth of 5% to 557 (see Figure 5, 6 and 7).

Figure 5: Number of invention patent applications filed by top 100 invention patent applicants by category

Figure 6: Number of utility model patent applications filed by top 100 utility model applicants by category

Figure 7: Number of design patent applications filed by top 100 design applicants by category

In 2016 the Taiwan Intellectual Property Office received 72,442 applications, down 2% from last year. Although there was growth in the number of design applications, applications for both other categories of patent – utility model and invention – fell 2%. Invention patents applications numbered 43,836, marking a slow in the decline over the last four years, falling by just 1% year on year; Utility model patents applications numbered 20,161, down 6% from last year; Design patents numbered 8,445, growth of 8% on last year (See Figure 8).

Figure 8: Invention patent, utility model patent, design patent and total patent filings from 2012-2016; Source TIPO report

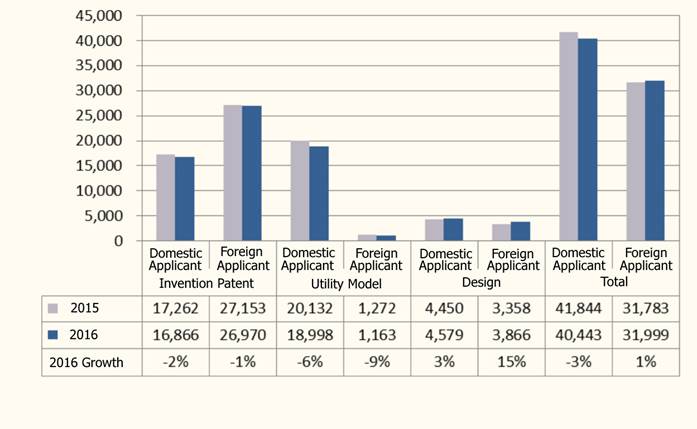

In terms of applicant nationality, Taiwanese applicants accounted for 40,443 patents, down 3% on last year, while applications by foreign applicants increased slightly by 1%, to 31,999. Among applications from local applicants, invention applications accounted for 16,866, which was the fifth year of decline, but the rate of decline slowed with a decrease of just 2%; design patents accounted for 4,579 applications, modest growth of 3%. In terms of applications from foreign applicants, there were 26,970 invention patent applications, a decline of 1% from last year; utility model patents saw a larger decrease of 9% to 1,163 applications, but design patents saw steep growth of 15%, increasing to 3,866 (See Figure 9).

Figure 9: Applications by domestic and foreign applicants for each category of patent, 2015-2016; Source: TIPO report

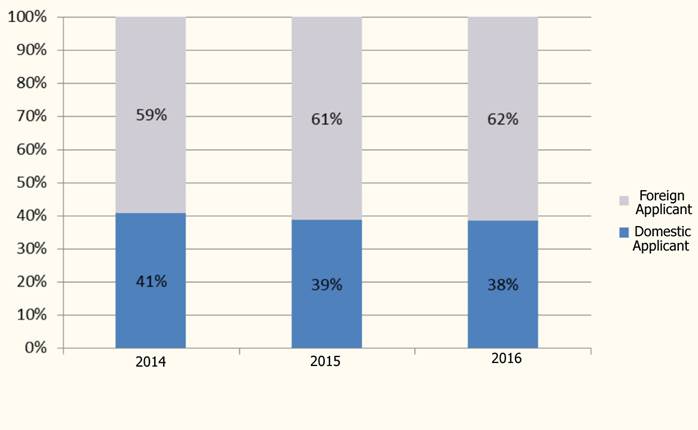

As invention patent applications from domestic applicants have decreased over the last three years and invention patent applications from foreign applicants have remained more or less level at around 27,000, the proportion of domestic applicants of the total has decreased from 41% in 2014 to 38% in 2016 (See Figure 10).

Figure 10: Applications from foreign and domestic applicants as a proportion of total applications; Source: TIPO report

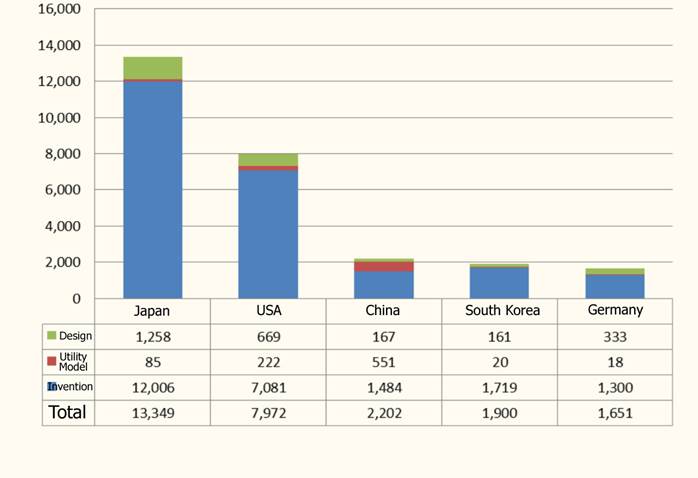

Taking a closer look at the countries of origin of foreign applicants for Taiwanese patents, the majority were from Japan and the US. Japanese applications for all three categories of patent totaled 13,349, still in the No.1 spot. The US followed in second place with 7,972 applications, followed by China at 2,202 applications. Invention patent applications from Japanese applicants totaled 12,006, while design patent applications totaled 1,258, making it the top applicant for the fifth year in a row, whereas Chinese applicants filed the most utility model patents with 551 (See Figure 11).

Figure 11: Patent applications by patent category from applicants from countries with largest number of applicants for Taiwanese patents; Source: TIPO report

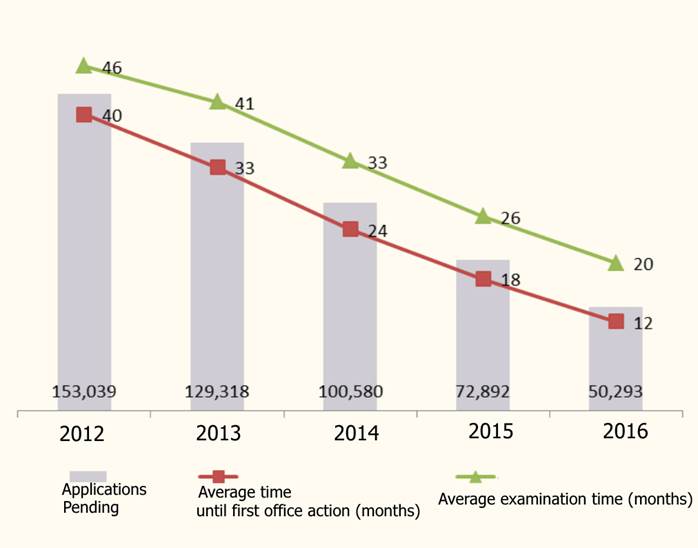

The time from application to receipt of first office action has been reduced to 12 months, and the average examination time was 20 months. The number of pending invention patent applications has also been reduced continually since 2012, to 50,293, as of the end of 2016 (See Figure 12).

Figure 12: Applications pending, average time to first office action and average examination time, 2012-2016; Source TIPO report

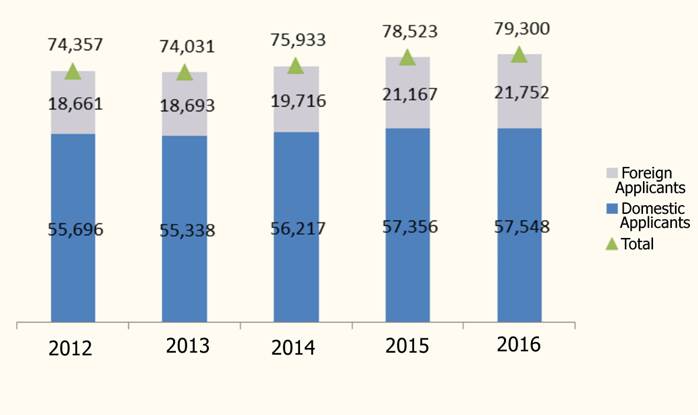

The Taiwan Intellectual Property Office received 79,300 trademark applications in 2016, a new high, and an increase of 1% on last year. 57,548 applications were from domestic applicants, whereas 21,752 were from foreign applicants, slight growth year on year (See Figure 13).

Figure 13: Trademark registrations from foreign and domestic applicants and total applications, 2012-2016; Source: TIPO report

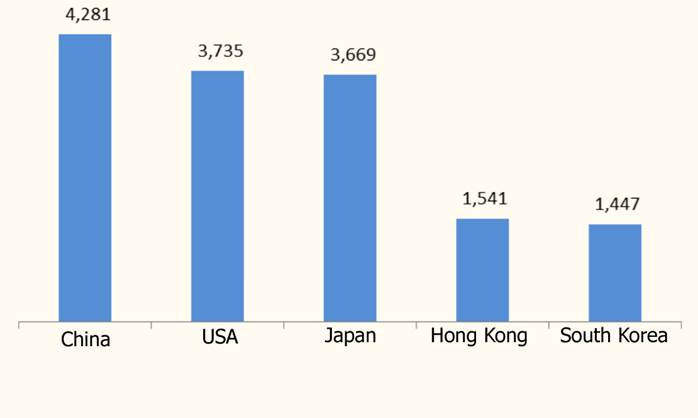

In terms of foreign applicants for trademark applications in Taiwan, China filed 4,281 applications, a 9% increase year on year, more than the US with 3,735 applications and Japan with 3,669 applications (See Figure 14).

Figure 14: Trademark applications from countries/areas with largest number of applications for Taiwanese trademarks; Source: TIPO report

The IP Observer recently interviewed the chair of the Taiwan Patent Attorneys Association who shared his predictions for the coming years.

|

|

| Author: |

Conor Stuart |

| Current Post: |

Senior Editor, IP Observer |

| Education: |

MA Taiwanese Literature, National Taiwan University

BA Chinese and Spanish, Leeds University, UK |

| Experience: |

Translator/Editor, Want China Times

Editor, Erenlai Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|